Introduction

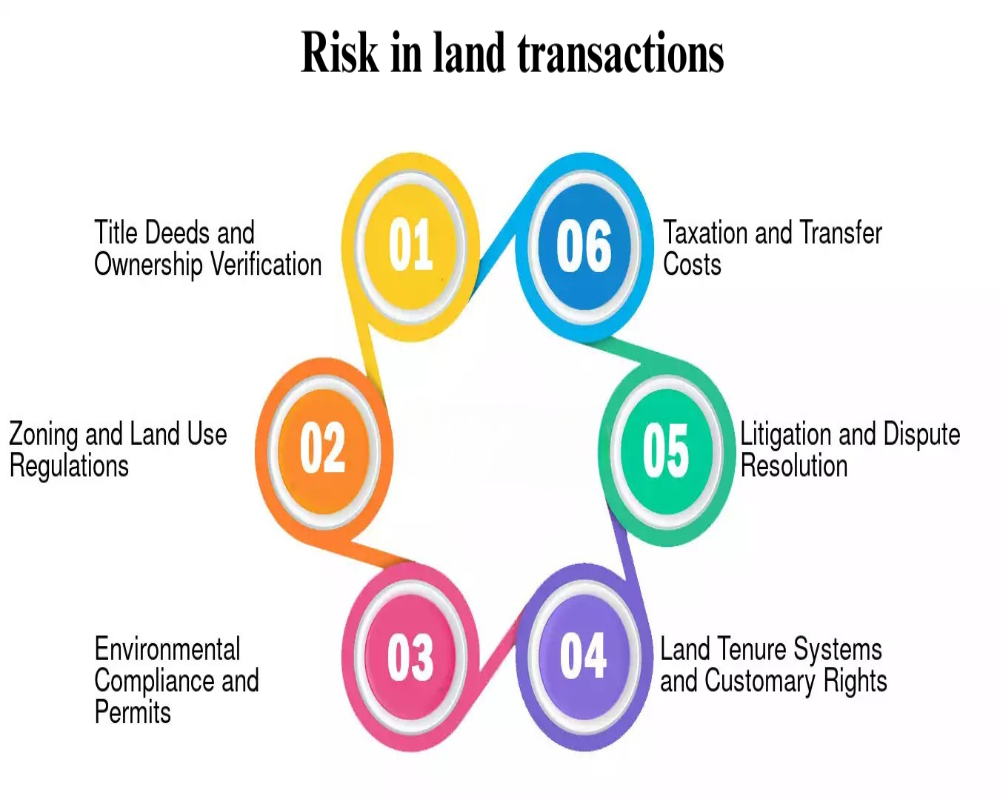

Pre-zoned land is often considered a safe and investment-ready asset because of its designated land use status. However, these transactions still carry significant risks that can affect financial viability, development timelines, and legal compliance. Buyers sometimes overlook deeper due diligence assuming zoning approval means immediate usability. Risks may arise from unclear titles, infrastructure limitations, changing regulations, or misinterpretation of permissible uses. A detailed understanding of these risks is essential for informed investment. Proper risk assessment protects against unexpected delays, costs, and legal disputes.

Title and Ownership Disputes

Even pre-zoned land can suffer from unclear ownership records or multiple claims. If the land title is not properly registered or transferred, buyers may face legal challenges after purchase. Hidden encumbrances like pending mortgages or unresolved inheritance claims can surface later. Government land or previously acquired plots may also have legal conditions attached. A comprehensive title search and legal opinion are necessary to avoid future litigation. Clear documentation is a critical safeguard in such transactions.

Land Encroachments and Boundary Issues

Physical occupation or encroachment by neighboring landowners or squatters can delay development. Survey mismatches between official records and actual boundaries can create conflicts. These issues can be difficult to resolve, especially in semi-urban or industrial transition zones. Encroachments may also involve illegal structures or disputed pathways. Government assistance may be needed to clear the land for legal use. Early physical inspection and survey verification are essential.

Misinterpretation of Zoning Conditions

While land may be pre-zoned, there are often detailed conditions attached to that zoning category. Buyers may assume all types of industries are permitted, when in fact only specific activities are allowed. Misreading the zoning certificate or not consulting with planning authorities can lead to rejection of development plans. Some areas may have environmental or height restrictions despite being zoned industrial. Consulting local development control rules avoids costly planning errors.

Infrastructure and Utility Gaps

Pre-zoned land does not always come with ready access to infrastructure like roads, water, or power. If the location is within a developing industrial corridor, basic utilities may still be pending or under construction. Buyers may have to bear additional costs to extend or upgrade services. The lack of immediate connectivity can delay project start and increase holding costs. This risk is often underestimated during site selection.

Environmental Restrictions and Approvals

Industrial zoning does not eliminate the need for environmental clearances or pollution control approvals. Some zones may fall under eco-sensitive or regulated areas where environmental rules are strict. The cost and time for compliance can be high, especially for red-category industries. Failure to obtain required permissions may result in rejection of construction or operational plans. Early environmental screening and feasibility analysis are essential.

Regulatory Delays and Policy Changes

Development plans must pass through multiple layers of government approval even if the land is pre-zoned. Delays in building plan sanctions, fire safety clearances, or utility permits can slow the project. In some cases, local development policies may change, affecting zoning criteria or project viability. New land pooling schemes or rezoning exercises may alter the land’s value or use. Staying informed about local planning updates helps mitigate this risk.

Legal Non-Compliance of Previous Owners

If the previous landowner violated zoning rules or undertook unauthorized construction, the new buyer could inherit these liabilities. Pending fines, demolition orders, or legal notices may not be immediately apparent. Such issues can affect the approval of new plans or financing eligibility. Proper investigation of historical land use and municipal records is critical. Legal vetting of ownership history protects against future claims.

Financing and Valuation Challenges

Banks and financial institutions may hesitate to finance pre-zoned land if supporting infrastructure or documentation is incomplete. The land may be overvalued based on its zoning status without considering development readiness. This can lead to lower-than-expected loan sanctions or higher equity requirements. Lack of valuation accuracy can distort financial planning. Third-party appraisal and consultation with lenders help identify realistic funding possibilities.

Disputed Access and Right of Way

Some industrial plots may have issues related to road access or shared passage rights. Legal access through private or government land may not be properly documented. Shared access with other landowners can lead to usage disputes. Without guaranteed and clear access, the land’s usability and value are compromised. Buyers should secure legal rights of way through registered agreements.

Operational Suitability and Market Viability

Zoning status alone does not guarantee that the land is commercially or operationally viable. Factors like proximity to labor, demand clusters, or supply chains also affect usability. A plot may be zoned but located in an inactive or declining industrial area. Lack of demand can reduce tenant interest or resale potential. Market study and demand forecasting are necessary alongside zoning analysis.

Conclusion

Pre-zoned land transactions offer the advantage of legal land use clarity but come with a wide range of risks that require detailed assessment. Issues such as title disputes, infrastructure gaps, and zoning misinterpretations can impact project feasibility and timelines. Regulatory delays, environmental concerns, and access problems further complicate development. Relying solely on the zoning label without deeper due diligence exposes buyers to financial and legal setbacks. A structured evaluation process is essential to ensure that the land not only meets regulatory approval but also aligns with operational and market goals. Strategic planning and professional consultation are key to managing these risks effectively.

Hashtag

#PreZonedLand #LandTransactions #RealEstateRisks #PropertyInvestment #ZoningLaws #LandDevelopment #RealEstateTips #InvestmentRisks #LandUse #PropertyLaw #ZoningRegulations #RealEstateEducation #RiskManagement #LandAcquisition #DueDiligence #RealEstateMarket #PropertyDevelopment #ZoningIssues #LandInvestment #RealEstateAdvice