1. Residency Status Under Income Tax Law

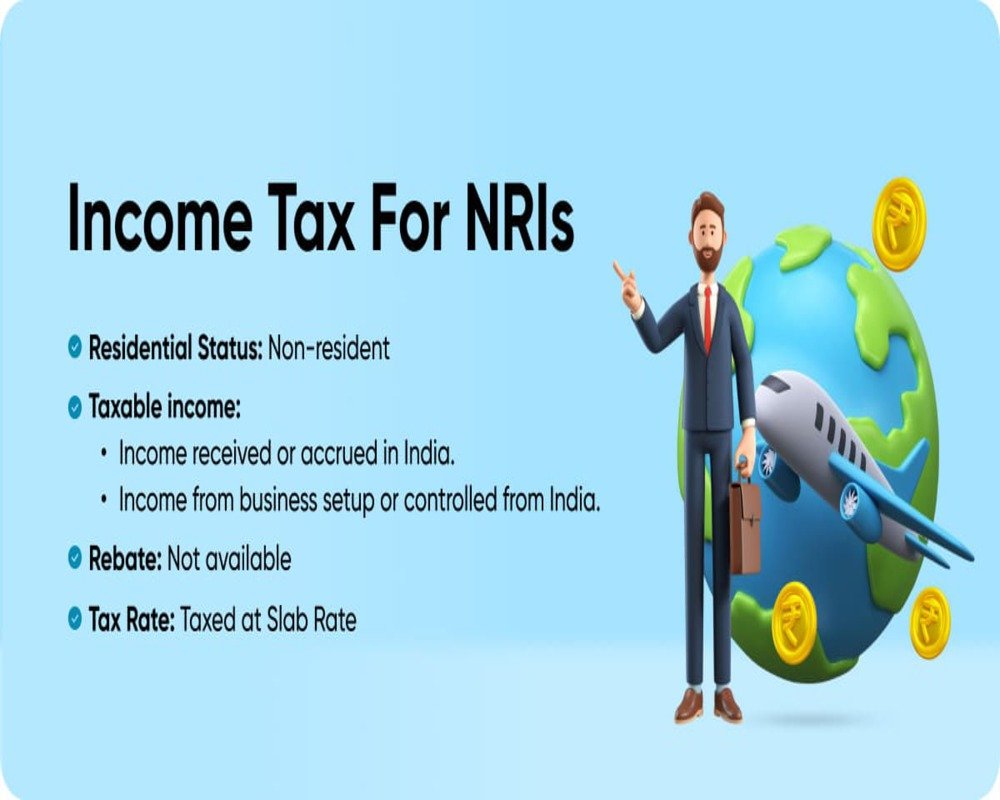

The Income Tax Act, 1961 classifies individuals as Resident, Resident but Not Ordinarily Resident (RNOR), or Non-Resident Indian (NRI) based on their physical presence in India during the financial year. NRIs are:

- Individuals who stay outside India for 183 days or more in a financial year

- Taxed only on income earned or received in India, not their global income

This differentiation in tax base leads to distinct tax treatments compared to residents.

2. Higher TDS Rates on Income Earned in India

Income received by NRIs in India—such as from sale of land, rental income, or capital gains—is subject to:

- Higher withholding tax (TDS) under Section 195, often at 20% or more

- Inclusion of surcharge and health & education cess, increasing the effective rate

- TDS is deducted on gross amount, not just net gain, unless a lower deduction certificate is obtained

This ensures tax collection at source, as NRIs are not easily traceable for post-sale tax recovery.

3. Limited Access to Exemptions and Deductions

NRIs are restricted from claiming certain exemptions and deductions available to residents, including:

- No benefit under Section 54 for buying a second house in India

- Ineligibility for deductions under Section 80C for specific investments (e.g., PPF, NSC)

- Limitations on agricultural income exemption, depending on source and usage

These exclusions aim to prevent misuse of tax reliefs by non-resident earners.

4. Mandatory Filing and Repatriation Compliance

Tax compliance for NRIs involves:

- Filing returns in India if total Indian income exceeds the basic exemption limit

- Reporting capital gains, rental, and interest income in ITR forms specifically designated for NRIs

- Adherence to FEMA (Foreign Exchange Management Act) rules for repatriating sale proceeds

These requirements reflect cross-border regulatory frameworks and efforts to monitor overseas transactions.

5. Double Taxation Avoidance Agreement (DTAA) Provisions

India has signed DTAAs with many countries to prevent double taxation for NRIs. Under DTAA:

- NRIs can claim tax credits or exemptions in their country of residence

- Specific lower rates may apply to interest, dividend, or capital gains income

- A Tax Residency Certificate (TRC) must be submitted to avail these benefits

DTAA treatment introduces country-specific variations in how NRIs are taxed.

6. Stringent Compliance to Curb Black Money and Benami Transactions

Due to concerns around illicit fund flows, NRIs face:

- Tight KYC norms and property ownership disclosures

- Restrictions under the Benami Transactions (Prohibition) Act

- Higher scrutiny by tax authorities and financial intelligence units

This contributes to differentiated treatment, ensuring transparency and tax accountability in overseas transactions.