1. State-Level Authority Over Stamp Duty Rates Stamp duty is governed by the Indian Stamp Act, 1899, but the power to levy and collect it lies primarily with state governments. Each state: Has its own stamp duty legislation and rate structure Can revise stamp duties periodically through state budgets or notifications Applies different rates for residential, commercial, industrial, and...

Industrial Sales

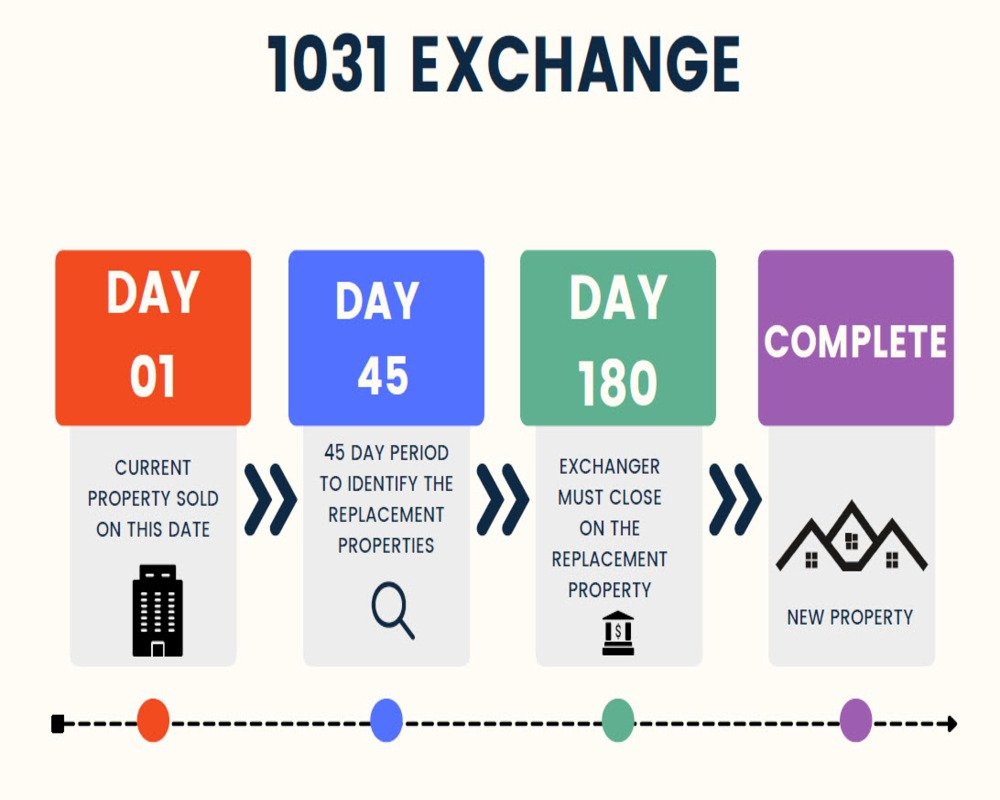

1. Section 54F – Investment in Residential Property If a seller reinvests the net sale proceeds from a long-term capital asset (such as industrial or commercial land) into a residential house property, they can claim exemption under Section 54F of the Income Tax Act. Key conditions include: The new residential property must be purchased within 1 year before or 2 years after, or constructed within...

1. Through PAN-Based Transaction Reporting Every land transaction exceeding prescribed thresholds requires mandatory quoting of the Permanent Account Number (PAN) by both buyer and seller. This information is captured in: Sale deeds registered with Sub-Registrar Offices TDS forms such as Form 26QB for transactions over ₹50 lakh Annual Information Statement (AIS) generated by the Income Tax...

1. Income Tax Department of India The Permanent Account Number (PAN) is issued by the Income Tax Department of India through its authorized agencies. It is a unique 10-digit alphanumeric code used to track financial transactions and tax obligations of individuals and entities. The PAN is essential for parties involved in land transactions, as it is: Mandatory for property transactions exceeding...

1. Income Tax Return (ITR) Filing After selling land, the seller must report the capital gains in their annual Income Tax Return for the relevant assessment year. Key aspects include: Filing under ITR-2 (for individuals with capital gains) or ITR-6 (for companies) Reporting the gross sale consideration, cost of acquisition, improvement, and transfer expenses Calculation and declaration of...

1. Residency Status Under Income Tax Law The Income Tax Act, 1961 classifies individuals as Resident, Resident but Not Ordinarily Resident (RNOR), or Non-Resident Indian (NRI) based on their physical presence in India during the financial year. NRIs are: Individuals who stay outside India for 183 days or more in a financial year Taxed only on income earned or received in India, not their global...

1. Board Resolution and Internal Approvals Are Mandatory When a company owns land, it cannot be sold by a single individual without proper authorization. The process requires: A Board Resolution approving the sale of the property Shareholder approval in case the land sale constitutes a significant portion of the company’s assets (as per Section 180 of the Companies Act, 2013) Documentation...

1. TDS Under Section 194-IA (Applicable to Residents) When an individual or HUF sells immovable property (land or building) other than agricultural land, and the sale consideration is ₹50 lakh or more, the buyer is required to: Deduct TDS at 1% on the total sale consideration Deposit the TDS with the Income Tax Department using Form 26QB Issue a TDS certificate in Form 16B to the seller...

1. Helps Defer or Avoid Long-Term Capital Gains Tax Section 54F of the Income Tax Act provides an exemption from long-term capital gains (LTCG) tax if the proceeds from the sale of industrial land (or any long-term capital asset other than a residential house) are invested in: The purchase or construction of a new residential house property in India Within 1 year before or 2 years after the sale...

1. Definition of Capital Gains Capital gains tax is levied on the profit earned from the sale of a capital asset, such as industrial land. The gain is calculated as: Capital Gain = Sale Consideration – (Indexed Cost of Acquisition + Improvement + Transfer Expenses) It is categorized into two types based on the holding period of the land before sale. 2. Short-Term Capital Gains (STCG) If...