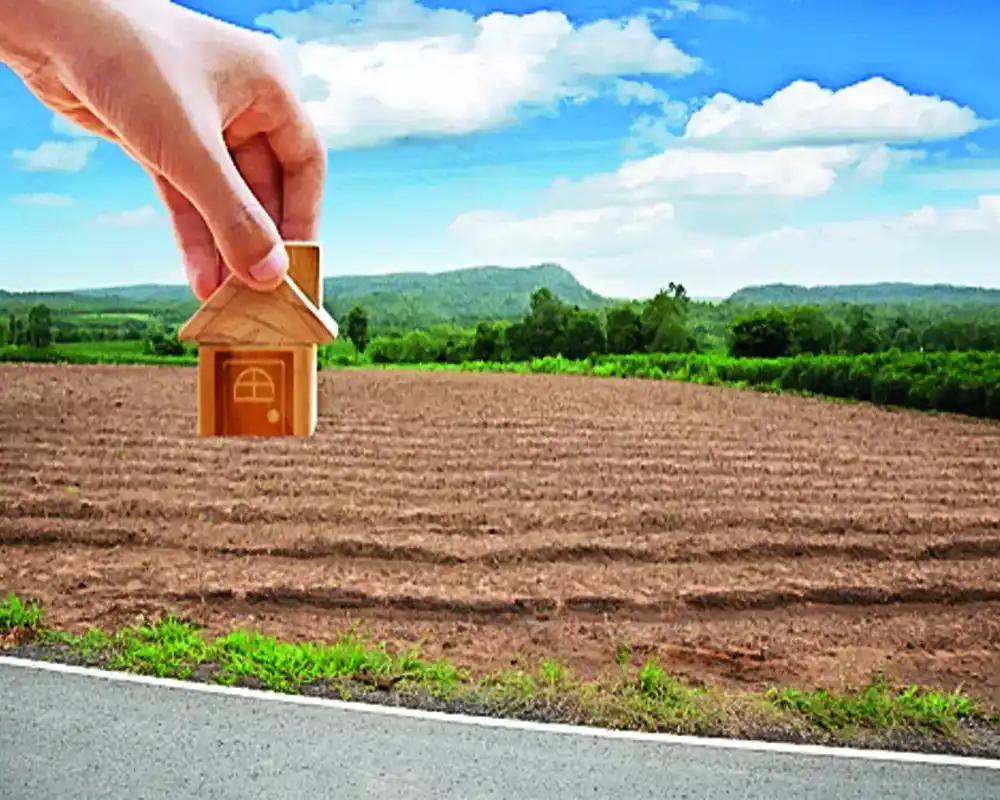

A fast-growing trend in India’s commercial real estate sector is the emergence of short-term land holding as a distinct and highly profitable investment niche. Traditionally viewed as a long-term asset, land is now being strategically acquired, held for brief windows—typically 6 to 24 months—and sold at a premium, often without any development activity. This approach is gaining traction among...

Commercial Investment

As land values surge across India’s urban and peri-urban corridors, a growing number of investors are turning to flip-and-sell strategies to extract short-term profits from the booming commercial land market. These strategies involve acquiring undervalued or early-stage parcels—often raw or newly rezoned land—then quickly reselling them after a price spike triggered by infrastructure approvals,...

India’s commercial land market is witnessing a sharp surge in fast resale deals for high-traffic plots, as investors and land flippers target parcels located along major arterial roads, expressways, and upcoming transit corridors. These strategically positioned plots—often near metro stations, flyovers, or commercial hubs—offer immediate visibility and footfall, making them ideal for retail outlets,...

India’s suburban commercial land markets are increasingly being shaped by the buy-and-flip investment model, as investors capitalize on the rapid appreciation driven by zoning relaxations, infrastructure expansion, and early-stage development momentum. With prime urban plots becoming unaffordable or overbuilt, suburban corridors have emerged as the new frontier, offering lower entry costs and...

India’s emerging commercial corridors are experiencing a surge in buy-and-flip activity, as investors rush to capitalize on rapid land value appreciation fueled by infrastructure upgrades, zoning liberalization, and escalating demand from developers and end-users. The strategy—simple in execution but rich in returns—involves buying raw or underpriced commercial land, holding it through a key growth...

With commercial real estate development timelines growing longer due to regulatory bottlenecks, environmental clearances, and rising construction costs, a rising number of investors are pivoting to the flip model—a strategy focused on quick acquisition and resale of land—to maintain capital velocity and reduce exposure to long-horizon risks. This shift marks a significant trend in India’s land...

India’s urban real estate boom is driving commercial land flipping to new heights, as demand for strategically located, development-ready plots surges in tandem with infrastructure growth and zoning liberalization. Flippers—ranging from private investors to real estate syndicates—are aggressively acquiring undervalued or early-stage land parcels in fast-expanding corridors, then reselling them...

India’s evolving commercial real estate market is increasingly attracting opportunistic investors who are capitalizing on short-term land plays to generate quick, high-margin returns. By targeting undervalued or under-the-radar commercial land—especially in rapidly developing corridors—these investors buy early and exit fast, often within 6 to 24 months, as soon as zoning approvals, infrastructure...

A new investment formula is taking root in India’s commercial land market: Buy Low, Zone Smart, Sell Fast. With infrastructure development surging and zoning reforms sweeping across urban and peri-urban areas, savvy investors are increasingly targeting undervalued raw or misclassified land, purchasing at early-stage prices, then leveraging zoning intelligence and regulatory timing to dramatically boost...

India’s commercial land market is gaining momentum in flip-friendly zones, where rising demand, infrastructure development, and rezoning trends are creating fertile ground for short-cycle investment strategies. These zones—typically located on the fringes of Tier I cities or within fast-expanding Tier II urban centers—are characterized by low entry costs, high visibility, and predictable...