A well-structured tenant mix strategy tailored to neighborhood demographics and spending patterns ensures that a development is not only economically sustainable but also responsive to community needs. This strategy helps maximize foot traffic, promote cross-visitation between uses, and enhance tenant success. Aligning the mix with local characteristics creates a vibrant, resilient destination that...

Commercial Investment

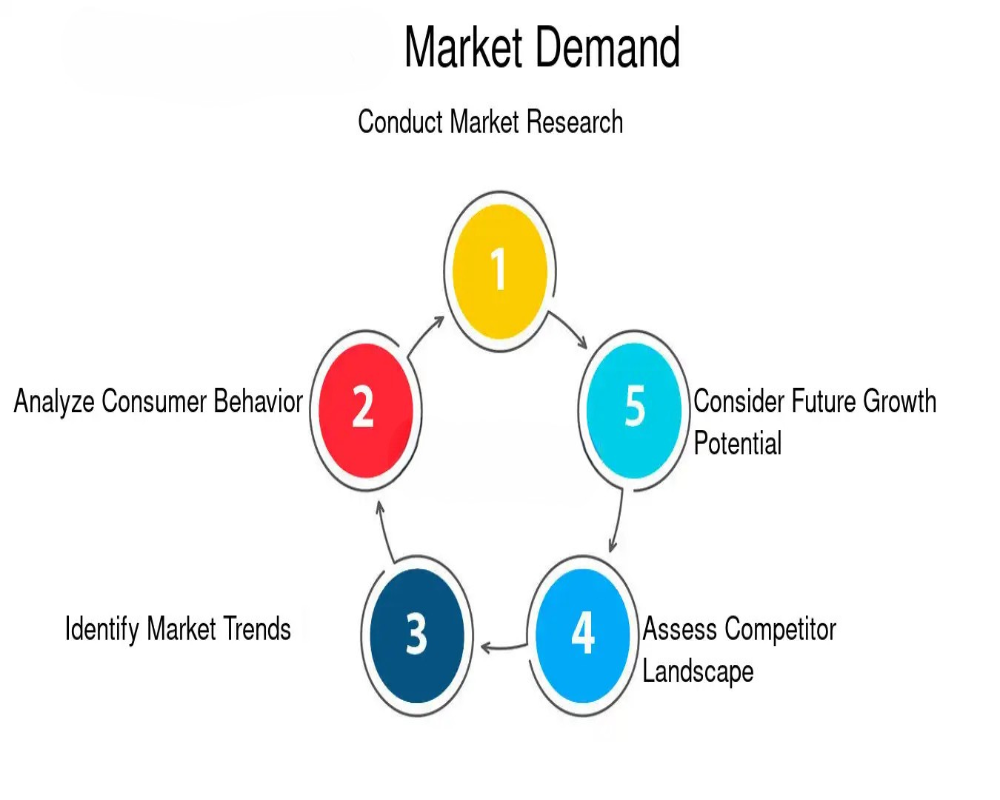

Understanding market demand for each use type—residential, retail, and office—within a development’s trade area is fundamental to determining feasibility, phasing, and financial viability. Demand is driven by demographic trends, economic activity, competitive supply, and consumer behavior. A comprehensive demand analysis aligns the development program with the actual needs and growth potential of...

A well-planned phasing strategy is crucial for the successful integration of residential, retail, and office components in a mixed-use development. Phasing ensures that each component is delivered at the right time to match market demand, minimize risk, and create synergy across uses. It also allows flexibility to adapt to changing economic conditions, tenant preferences, and infrastructure...

Density, height, and Floor Area Ratio (FAR) are core zoning and planning controls that directly determine how much development can occur on a given site. These three parameters collectively shape the scale, layout, and profitability of any project, especially for commercial and mixed-use developments. Understanding how they apply in a specific zoning district is crucial for calculating potential yield,...

Understanding zoning classifications and overlay districts is essential when evaluating whether a site can support mixed-use development. Mixed-use zoning allows a combination of residential, commercial, office, and sometimes institutional uses within a single development or site. However, such uses must conform to local zoning laws and any applicable overlays, which can significantly influence design,...

Tenant Improvement Allowances (TIAs) are a key cost consideration in commercial land development. These allowances represent the funds a landlord or developer provides to tenants to customize or improve the leased space to suit their operational needs. Factoring these costs accurately is essential for budgeting, financing, and setting competitive lease terms that attract quality tenants. 1. Scope and...

When evaluating commercial land investments, understanding tenant preferences in lease structures is critical. The lease model not only affects your cash flow and responsibilities as a landlord but also determines how attractive your property is to specific types of tenants. Tenants in different sectors often have clear expectations regarding lease terms, and aligning with these can lead to more stable,...

Utility capacities and availability are fundamental to supporting commercial retail usage, as they directly impact tenant operations, regulatory compliance, and the ability to secure occupancy approvals. Utilities must not only be present but also be of adequate capacity, scalable, and legally sanctioned for commercial purposes. Insufficient or delayed utility access can deter national tenants, delay...

Land improvement costs are a critical part of retail development feasibility, especially during early site preparation and entitlement. These costs are incurred to make raw or partially serviced land suitable for tenant occupancy, code compliance, and long-term operational efficiency. If not properly anticipated, they can erode profit margins, delay construction, or weaken project viability from a...

To secure development financing—especially from banks or institutional lenders—pre-leasing commitments are often a critical requirement. Pre-leasing reduces the perceived risk of vacancy, ensures predictable revenue upon completion, and strengthens the borrower's ability to repay the loan. Lenders use these commitments as a form of income underwriting to justify construction or bridge financing for...