Introduction

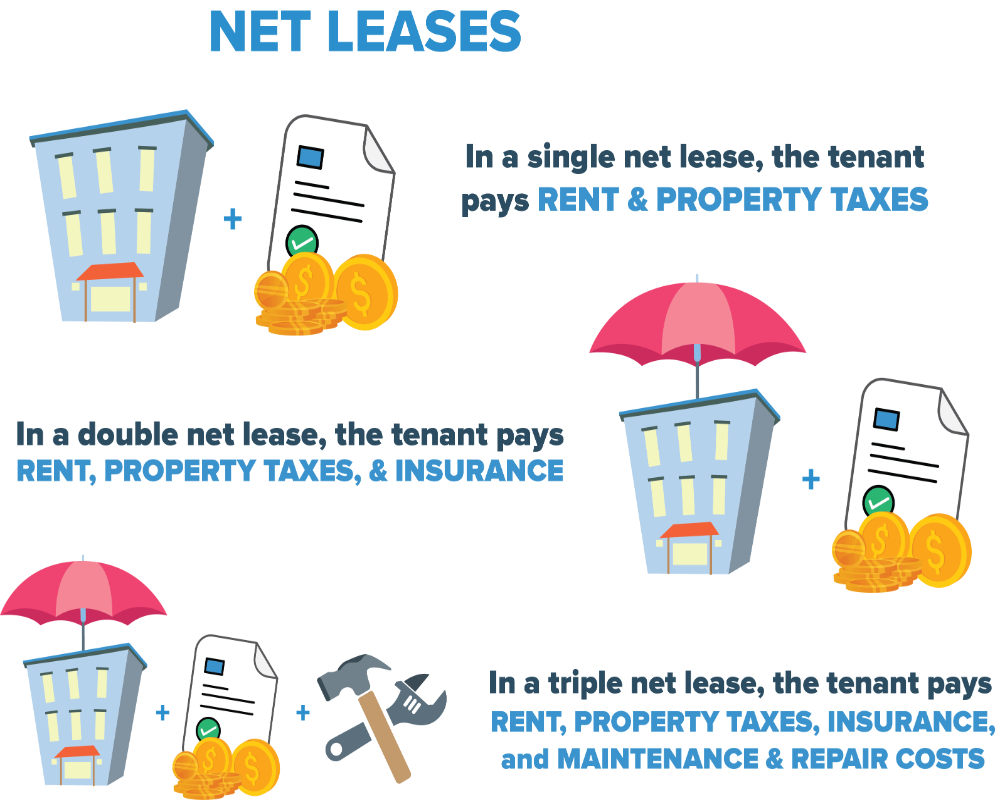

In industrial land leasing, the structure of lease agreements plays a significant role in determining the responsibilities, risks, and financial outcomes for both landlords and tenants. Among the various lease structures, the net lease is particularly common and widely used in industrial settings. A net lease is an agreement in which the tenant agrees to pay not only rent for the leased land but also additional costs associated with property ownership. These may include property taxes, insurance, and maintenance expenses. This model offers landlords a more predictable income and tenants greater control over operational costs. Understanding the specific elements of a net lease is essential for structuring a lease that balances interests and promotes long-term success.

Base Rent as the Core Payment

The base rent is the foundational financial component of a net lease. It is the fixed amount that the tenant pays periodically—usually monthly or annually—to the landlord for the right to occupy and use the industrial land. This base rent is established during lease negotiations and reflects factors such as location, land value, market trends, and the terms of the lease. While it forms the core of the landlord’s income from the property, in a net lease, this rent is often lower than in gross lease structures because additional operational costs are shifted to the tenant. The predictability of base rent ensures a steady income stream for the landlord over the lease term.

Property Tax Responsibility

In a net lease, the tenant is generally responsible for paying all property taxes levied on the land. This includes municipal taxes, land-use fees, and any other government-imposed levies applicable to the property. The lease agreement must specify how tax payments will be handled, including the frequency of payments, method of calculation, and any required documentation. Shifting this responsibility to the tenant reduces the landlord’s financial burden and risk exposure. For tenants, this arrangement provides greater transparency into the total cost of occupancy and incentivizes efficient land use that aligns with local regulations.

Insurance Coverage Obligations

Insurance is another key element of a net lease in industrial land leasing. Under this structure, the tenant must obtain and maintain insurance coverage for various risks related to the leased premises. Common policies include general liability insurance, property damage coverage, fire insurance, and sometimes business interruption insurance. The lease agreement usually requires the tenant to list the landlord as an additional insured party. This ensures that both parties are protected in the event of damage, accidents, or legal claims. Transferring the insurance responsibility to the tenant simplifies the landlord’s role and provides assurance that the property and associated activities are adequately protected.

Maintenance and Repairs of the Premises

A hallmark of net lease agreements is the tenant’s responsibility for maintaining and repairing the leased property. This includes routine upkeep such as landscaping, waste disposal, and structural repairs as needed. In industrial settings, where heavy machinery and constant use can lead to wear and tear, maintenance obligations are especially critical. The lease should outline the scope of maintenance, acceptable standards, and inspection rights of the landlord. Transferring this responsibility to the tenant not only reduces costs for the landlord but also ensures that the tenant has an incentive to maintain the premises in a condition that supports their own operations effectively.

Utilities and Operational Costs

In a net lease, tenants typically bear the full cost of utilities and services necessary for their operations. This includes electricity, water, gas, sewage, internet, and other applicable services. The tenant sets up accounts in their own name and pays suppliers directly. This element aligns with the principle that tenants should bear the costs of their own consumption. Including utility responsibilities in the lease avoids disputes over usage and ensures uninterrupted service. It also allows tenants to manage their own operational efficiency, an important factor in industrial leasing where utility expenses can form a large part of overhead costs.

Compliance and Legal Responsibilities

Under a net lease, the tenant is also responsible for ensuring compliance with all applicable laws, regulations, and ordinances affecting the leased property. This includes obtaining permits, adhering to environmental regulations, and complying with labor, zoning, and safety laws. The tenant must ensure that their activities do not cause legal violations or impose liability on the landlord. Lease agreements usually include indemnification clauses that protect the landlord from legal consequences resulting from the tenant’s non-compliance. These legal obligations are essential for maintaining operational legality and safeguarding the interests of both parties.

Capital Improvements and Alterations

While routine maintenance is the tenant’s obligation, the lease must also address the issue of capital improvements and major alterations. In many net lease agreements, tenants are allowed to make improvements that enhance operational efficiency, subject to the landlord’s prior written approval. These could include constructing additional structures, upgrading access roads, or modifying drainage systems. The lease must clearly define which party bears the cost of such improvements and who owns them at lease termination. Handling capital improvements transparently helps avoid disputes and supports productive investment in the leased premises.

Renewal Options and Rent Escalations

Net lease agreements often include clauses for lease renewal and rent escalation. These provisions help manage long-term expectations and adjust for inflation or market changes. Escalation clauses may specify fixed percentage increases or tie rent adjustments to an index such as the Consumer Price Index. Renewal options give tenants the ability to continue operations without disruption and offer landlords continued occupancy and income. Including detailed terms for these elements ensures clarity and avoids misunderstandings when the lease approaches expiration or periodic reviews become necessary.

Default and Termination Provisions

Another important element of a net lease is the inclusion of default and termination clauses. These provisions specify what constitutes a breach of the lease, such as failure to pay rent, non-performance of maintenance, or illegal use of the premises. Remedies for breach can include penalties, cure periods, lease termination, or legal action. For landlords, these clauses provide tools to protect their investment if the tenant fails to comply with the lease. For tenants, knowing the consequences of default helps enforce discipline and accountability. Well-drafted termination clauses also outline procedures for vacating the property and managing final obligations.

Transfer and Subletting Conditions

The ability of the tenant to transfer the lease or sublet the premises is another critical consideration in net lease structures. Most landlords restrict subletting or assignment without prior consent to maintain control over who occupies the land. The lease should detail the conditions under which subletting is permitted, including financial review of the new tenant, adherence to the original lease terms, and continuing liability of the original tenant. Allowing subleasing with safeguards gives tenants flexibility while ensuring that landlords are not exposed to new risks without their knowledge or approval.

Conclusion

Net lease elements in industrial land leasing create a well-balanced structure that shifts key responsibilities to the tenant while offering stable, predictable income for the landowner. These elements—ranging from base rent and taxes to maintenance, insurance, and compliance—define the financial and operational boundaries of the lease. By clearly outlining each party’s obligations, net leases minimize misunderstandings and legal risks. They also promote efficiency, accountability, and long-term viability for industrial land use. Properly structured net leases serve as a reliable foundation for investment, operational expansion, and strategic partnerships in industrial real estate.

Hashtag

#NetLease #IndustrialLeasing #RealEstateInvesting #CommercialRealEstate #LeaseElements #PropertyManagement #InvestmentStrategy #RealEstateTips #IndustrialProperties #LeaseAgreement #TenantResponsibilities #LandlordRights #RealEstateMarket #InvestmentProperty #CashFlow #TripleNetLease #RealEstateDevelopment #LeasingStrategy #PropertyInvestment #CommercialLeases