Raw or Unentitled Land These assets are usually held the longest due to entitlement risk and value realization timelines Typical hold period ranges from 5 to 10 years, especially in land banking strategies Requires zoning changes, infrastructure planning, or long-term market positioning Often acquired with speculative growth or public infrastructure alignment in mind Syndications may use...

Investment

History of Land Acquisitions and Assemblies A strong track record includes successful identification and consolidation of development-ready sites Proven ability to acquire single and multi-parcel sites in competitive or off-market conditions Demonstrated success in land assemblies supporting business parks, retail centers, or mixed-use zones Experience navigating holdout negotiations, option...

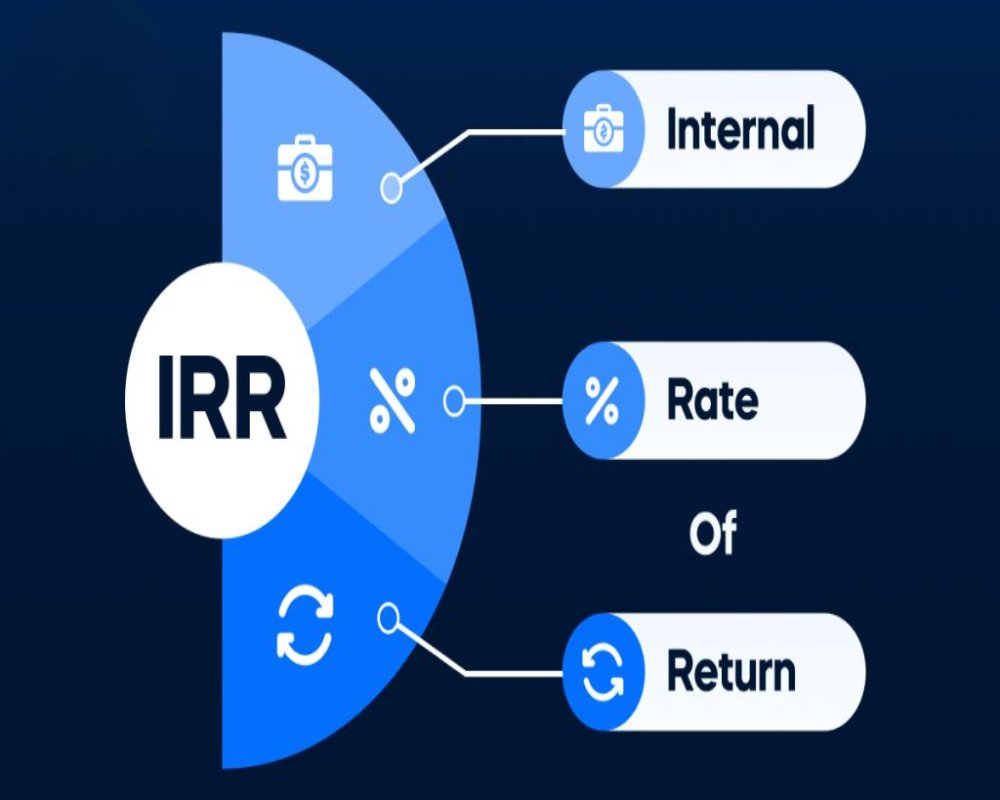

Internal Rate of Return (IRR) IRR measures the annualized return expected over the holding period, accounting for time-value of money Target IRR for raw or entitled land is typically between 14% and 25% Higher IRRs expected for riskier entitlement or land banking strategies Lower IRRs (10%–14%) may apply for pad-ready land with short hold and build-out plans IRR is highly sensitive to...

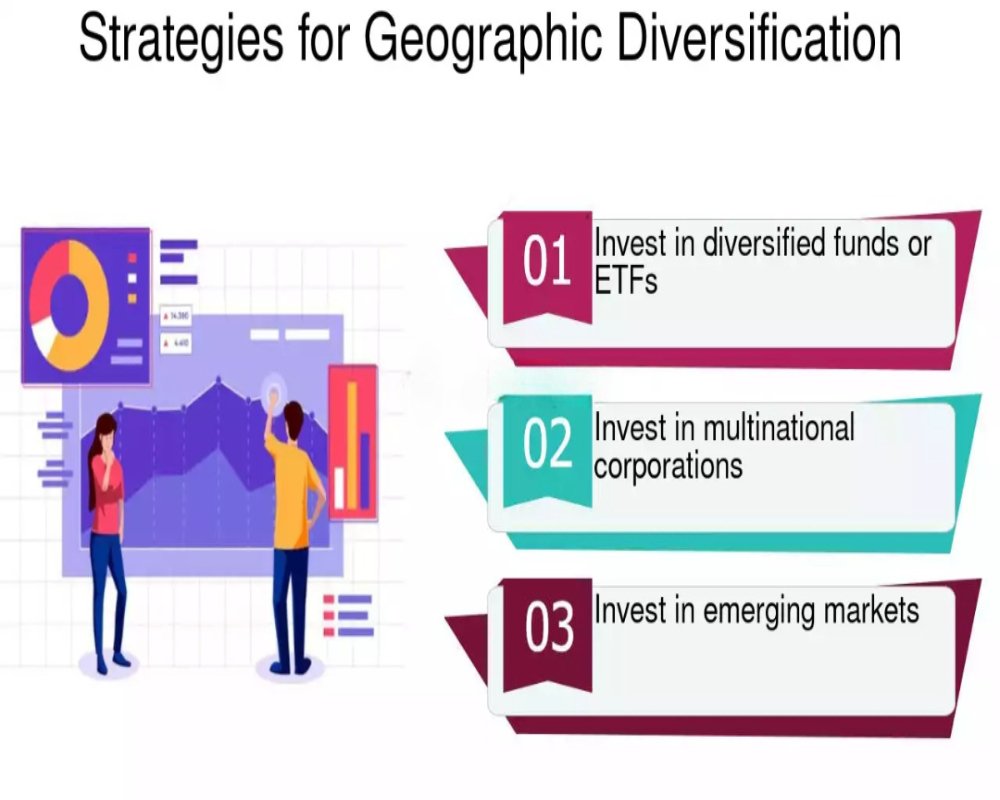

High-Growth Metropolitan Areas Funds prioritize dynamic urban regions where population and economic expansion drive long-term land demand Focus on Tier 1 and Tier 2 cities with consistent job growth and infrastructure spending Target locations with strong in-migration, such as Sunbelt metros (e.g., Austin, Phoenix, Atlanta) Demand linked to corporate relocations, innovation hubs, and...

Raw Land Allocation Raw land is typically a small but strategic portion of the portfolio due to its high risk and long-term nature Usually represents 5% or less of a diversified REIT or syndication portfolio Considered land banking for future appreciation or entitlement conversion Carries no immediate income, requiring longer hold periods and patient capital Often located in urban edge...

Target Asset Profile and Risk Appetite REITs and syndications operate under defined criteria that balance income stability, appreciation, and portfolio diversification Preference for shovel-ready or rezoned parcels with minimal entitlement risk Core-plus and value-add strategies seek underutilized land in growth corridors Risk-tolerant funds may pursue land banking or speculative urban edge...

Flexible Building Footprints and Floor Plates Mixed-use tenants require adaptable interior layouts to support a variety of functions over time Use clear-span structures with minimal interior columns to allow reconfiguration Plan for varying floor-to-floor heights (e.g., retail at 14–16 ft, office/residential at 10–12 ft) Incorporate shell space that can be adapted to office, retail, or...

Office Buildings Office uses generally require moderate parking ratios based on employee density and client traffic Typical ratio: 3 to 4 spaces per 1,000 square feet of gross floor area Higher ratios may apply in suburban or car-dependent areas without transit access Ratios may be reduced in TOD zones or with shared parking agreements Accessible and visitor parking must be factored in per...

Office Space Demand Demand for office space is shifting toward flexible layouts, transit-accessible locations, and hybrid work solutions Corporate tenants are downsizing footprints but upgrading to higher-quality, collaborative environments The strongest demand is in Class A buildings with wellness certifications and tech-enabled infrastructure Proximity to urban cores or TOD hubs drives...

Anchor-First Development Approach Begin with high-visibility or revenue-generating tenants to attract momentum and early cash flow Prioritize construction of a flagship office, retail, or logistics hub near main access points Anchor tenants help lease absorption in future phases by signaling long-term viability Early income can support infrastructure financing for later phases Strong...